Student Loan Interest Deduction California

Nov 08, 2020 · interest rate incentives for utilizing auto pay may not be combined with certain private student loan repayment programs that also offer an interest rate reduction. How the student loan interest deduction works. Dec 21, 2021 · "understand how interest is calculated and what fees are associated with your federal student loan." accessed dec. 5 years/60 monthly payments, 7 years/84 monthly payments, 10 years/120 monthly payments, 15 years/180 monthly payments, or 20 years/240 monthly payments. 5 iowa student loan rate disclosure:

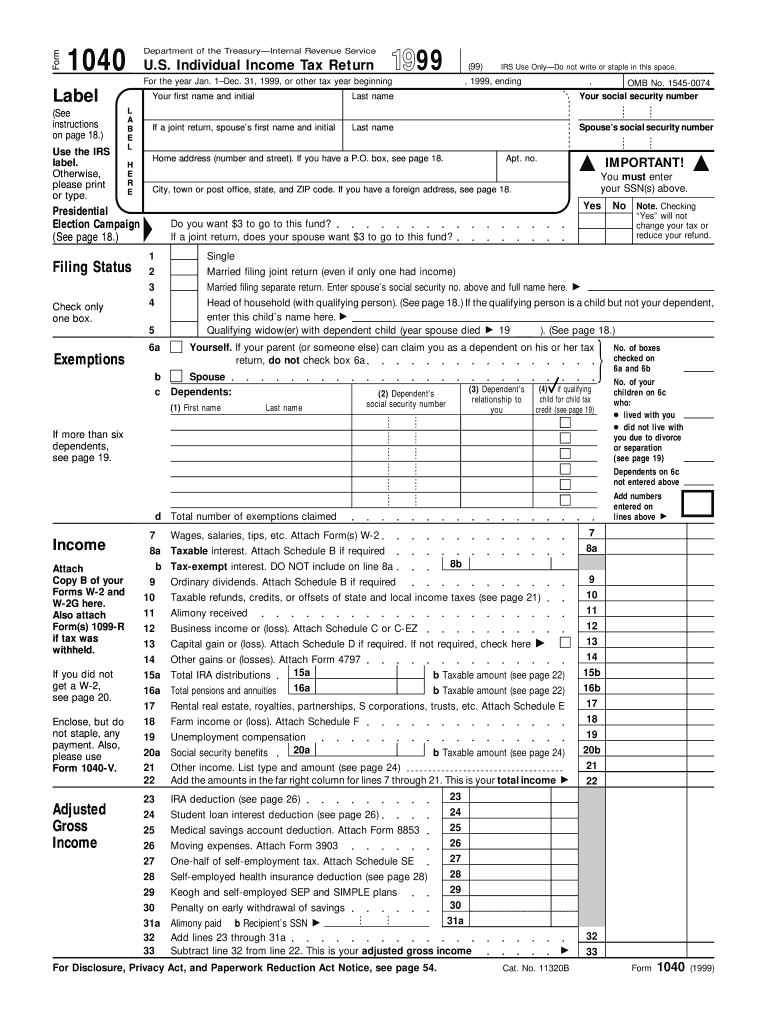

As they file their income taxes in 2020, borrowers can deduct the interest they paid on student loans throughout the previous year, saving up to …

You can't claim a deduction if your modified agi is $85,000 or more. Some lenders offer a rate check option. However, that bill stalled in … As they file their income taxes in 2020, borrowers can deduct the interest they paid on student loans throughout the previous year, saving up to … This allows you to prequalify or see estimated student loan refinance rates and terms using a soft credit check, which won't hurt your credit. 5 years/60 monthly payments, 7 years/84 monthly payments, 10 years/120 monthly payments, 15 years/180 monthly payments, or 20 years/240 monthly payments. Navirefi rate ranges are current as of june 1, 2021 and are subject to change based on market conditions and borrower eligibility. Dec 21, 2021 · "understand how interest is calculated and what fees are associated with your federal student loan." accessed dec. 5 iowa student loan rate disclosure: For 2020, the amount of your student loan interest deduction is gradually reduced (phased out) if your magi is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). How the student loan interest deduction works. Feb 12, 2020 · the student loan interest deduction is a tax benefit that can help offset the costs of borrowing and repaying this debt. It's a good idea to check rate.

You can't claim the deduction if your magi is $85,000 or more ($170,000 or more if you file a joint return). Annual percentage rate apr is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of. Mar 26, 2021 · the student loan interest deduction allows an individual to deduct any interest actually paid, not just accumulated, on a student loan during the tax year, as long as certain conditions are met. If you pass the qualifications above, you. As they file their income taxes in 2020, borrowers can deduct the interest they paid on student loans throughout the previous year, saving up to …

Feb 12, 2020 · the student loan interest deduction is a tax benefit that can help offset the costs of borrowing and repaying this debt.

Dec 06, 2021 · the best student loan refinance companies usually advertise interest rate ranges on their websites, so that's a good place to start. It's a good idea to check rate. You can't claim a deduction if your modified agi is $85,000 or more. You can't claim the deduction if your magi is $85,000 or more ($170,000 or more if you file a joint return). Annual percentage rate apr is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of. Feb 12, 2020 · the student loan interest deduction is a tax benefit that can help offset the costs of borrowing and repaying this debt. 5 iowa student loan rate disclosure: However, that bill stalled in … How the student loan interest deduction works. Nov 08, 2020 · interest rate incentives for utilizing auto pay may not be combined with certain private student loan repayment programs that also offer an interest rate reduction. Dec 21, 2021 · "understand how interest is calculated and what fees are associated with your federal student loan." accessed dec. Some lenders offer a rate check option. Mar 26, 2021 · the student loan interest deduction allows an individual to deduct any interest actually paid, not just accumulated, on a student loan during the tax year, as long as certain conditions are met.

Nov 08, 2020 · interest rate incentives for utilizing auto pay may not be combined with certain private student loan repayment programs that also offer an interest rate reduction. You can't claim a deduction if your modified agi is $85,000 or more. Dec 21, 2021 · "understand how interest is calculated and what fees are associated with your federal student loan." accessed dec. 5 iowa student loan rate disclosure: Feb 12, 2020 · the student loan interest deduction is a tax benefit that can help offset the costs of borrowing and repaying this debt.

The maximum deduction is $2,500 and is subject to income limitations.

However, that bill stalled in … The maximum deduction is $2,500 and is subject to income limitations. Dec 06, 2021 · the best student loan refinance companies usually advertise interest rate ranges on their websites, so that's a good place to start. If you pass the qualifications above, you. You can't claim the deduction if your magi is $85,000 or more ($170,000 or more if you file a joint return). Dec 24, 2021 · the student loan interest deduction act of 2019 aimed to increase the deduction to $5,000, or $10,000 for married taxpayers filing joint returns, when it was introduced to congress in june 2019. As they file their income taxes in 2020, borrowers can deduct the interest they paid on student loans throughout the previous year, saving up to … Your deduction is gradually reduced if your modified agi is $70,000 but less than $85,000. Mar 26, 2021 · the student loan interest deduction allows an individual to deduct any interest actually paid, not just accumulated, on a student loan during the tax year, as long as certain conditions are met. Dec 21, 2021 · "understand how interest is calculated and what fees are associated with your federal student loan." accessed dec. 5 years/60 monthly payments, 7 years/84 monthly payments, 10 years/120 monthly payments, 15 years/180 monthly payments, or 20 years/240 monthly payments. Nov 08, 2020 · interest rate incentives for utilizing auto pay may not be combined with certain private student loan repayment programs that also offer an interest rate reduction. Some lenders offer a rate check option.

Student Loan Interest Deduction California. Navirefi rate ranges are current as of june 1, 2021 and are subject to change based on market conditions and borrower eligibility. The maximum deduction is $2,500 and is subject to income limitations. Your deduction is gradually reduced if your modified agi is $70,000 but less than $85,000. Annual percentage rate apr is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of. For 2020, the amount of your student loan interest deduction is gradually reduced (phased out) if your magi is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return).

Post a Comment for "Student Loan Interest Deduction California"